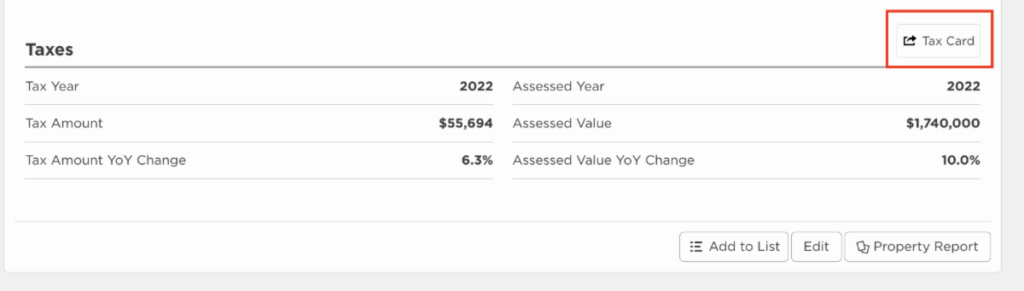

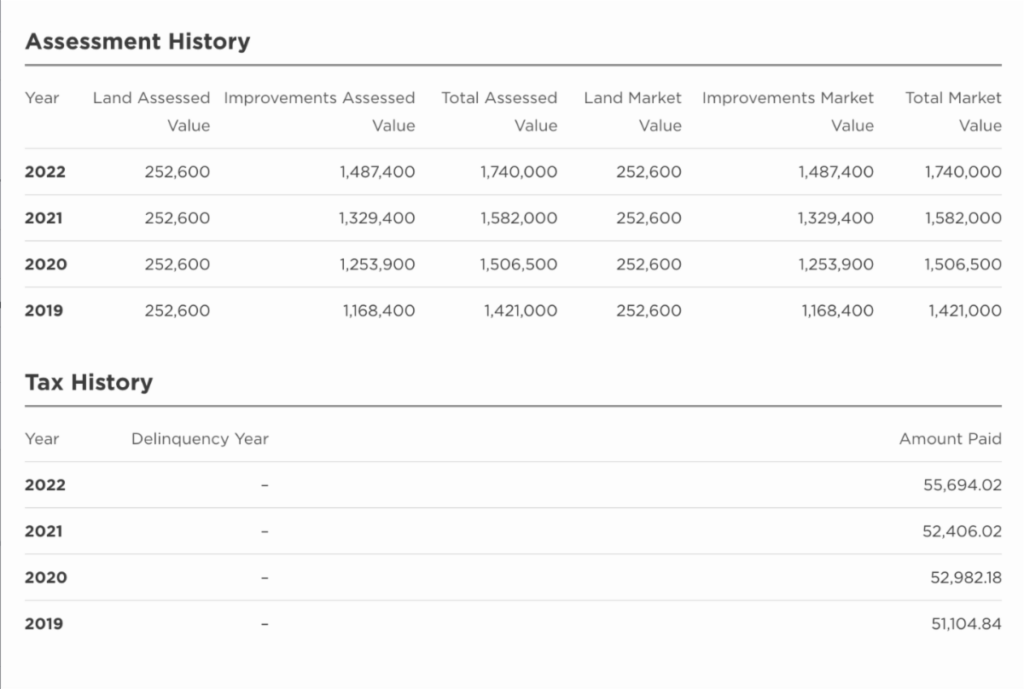

The new 2022 Tax Cards are now available on the property level. Tax assessor data assigned to Moody’s property records allow users to focus their research efforts on analyzing public record information in one place. A new “Taxes” section on the Property Details tab of property pages that reports a property’s tax burden and assessed value for the most recent year is available from the county assessor. A Tax Card information page and PDF export that includes the property’s current and historical tax and assessed value, as well as an overview of its structural attributes, ownership, location details, chain of title, and deed/mortgage history.

Contact us with questions on “2022 Tax Data” at 800-574-9185 x803 .

Contact us at 800-574-9183 x803 if you have any questions or wish to hear more about the CARW Commercial Data Exchange in partnership with REDICatylist/Moody’s

Join us Tuesdays or Thursdays on our LIVE Exchange System overviews. RSVP here

Click Here to become a CARW Commercial Data Exchange Member, lock your rates of just $135/mo guaranteed through December 31st, 2023, and join the hundreds of CARW Members united together for the most complete, accurate, and cost-effective marketing and data research service. Please contact us at info@redicatylist.com or 800-574-9185 x803 if you have any questions. See more at http://redicatylist.com/carw/

The CARW Commercial Data Exchange is Researched by REDI and Powered by Catylist/Moody’s.