In collaboration with the Marquette University Center for Real Estate and other industry partners, CARW participated in part 2 of a flash poll that occurred three weeks after the initial flash poll analyzing data from our Commercial Real Estate partners. The goal during this time of uncertainty was to share information, strategies and best practices to help define “What is market”.

Thank you to Andy Hunt with MUCRE for all of his hard work on this flash poll. Andy took time to walk CARW members through the results and answer questions on the data.

To listen to Andy’s analysis click HERE.

To view the flash poll results in its entirety, click HERE.

To listen to audio from Podcast from Part 1 of the Flash Poll, click HERE.

Key findings of the reports were:

- Longer impacts of COVID-19 and more pessimism as a whole. There was a 10% increase in people who felt the impact will last longer than 12 months.

- Fewer tenants approached landlords for assistance in April than initially expected.

- Tenant assistance strategies remained consistent in terms of type of help, but the overall percentages of help increased.

- Lenders strategies held consistent as well (interest only payments, deferment of principal interest, delaying payments, amortizing over the remainder of the loan).

- Hiring cuts slowing, most likely because staffing cuts have already been made.

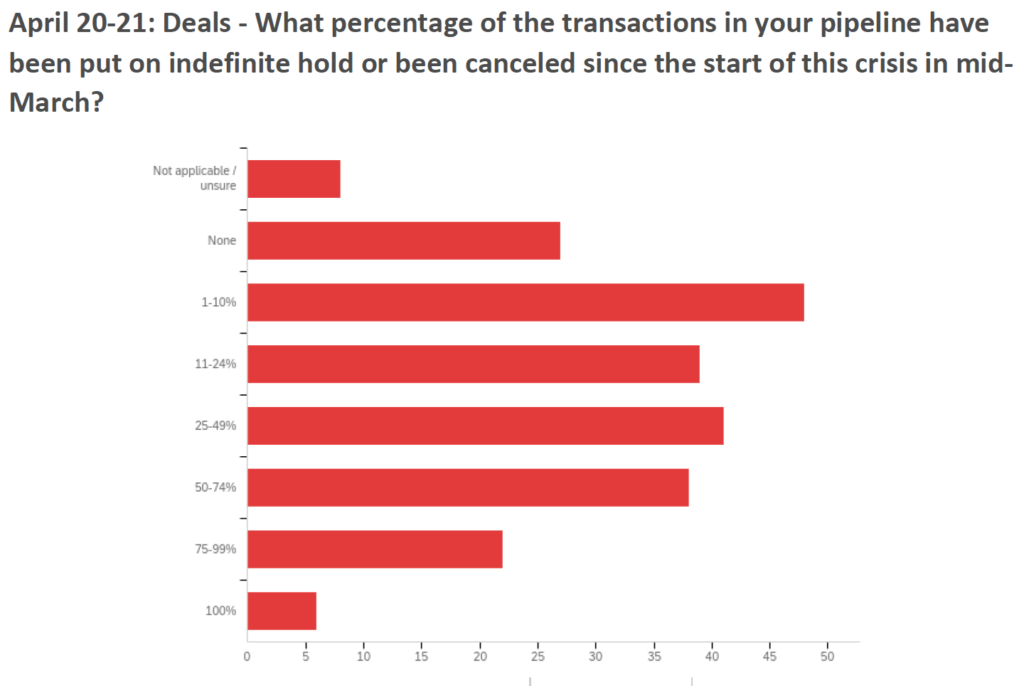

- Pipelines are shrinking – most respondents said that at least some transactions in their pipeline have been put on indefinite hold or cancelled.

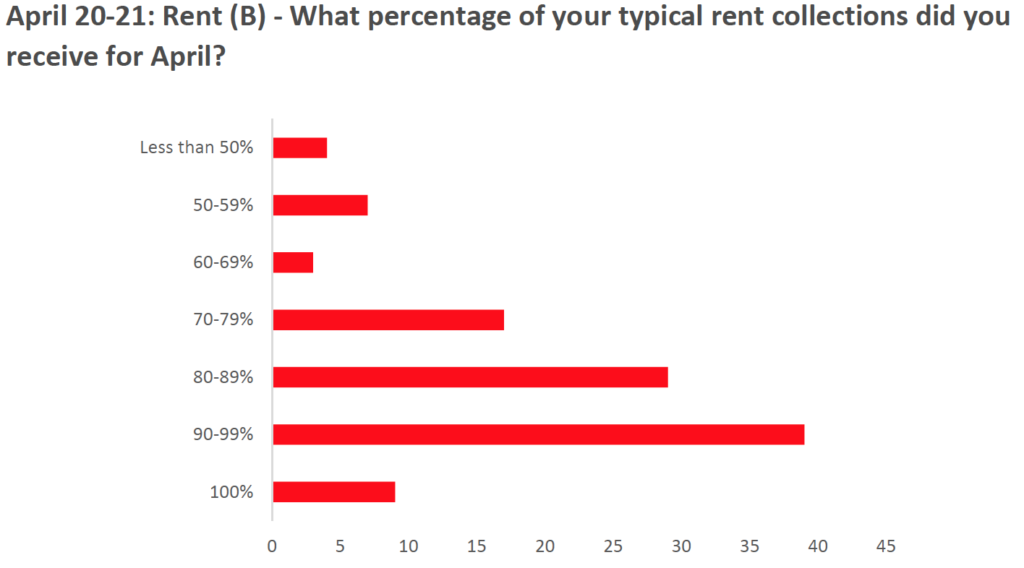

- Rent collections have decreased, while the majority of rent is still being collected, less than 10% actually collected all of their normal rent.

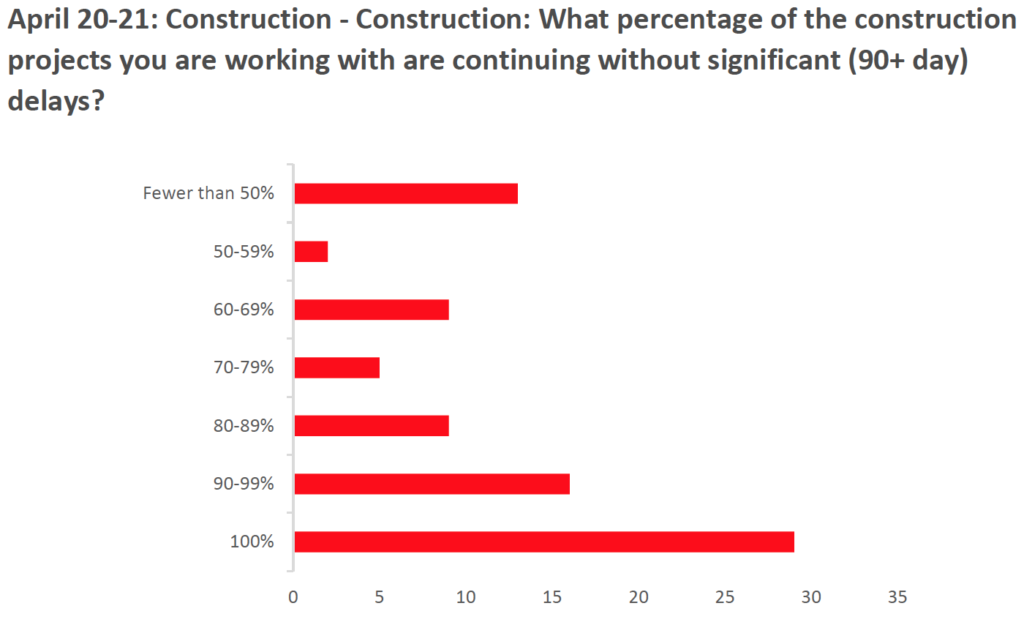

- Construction although considered essential, only 35% said their construction projects have continued without impact of delays.

- More than half believe stimulus is working and having a positive impact on the industry. However, almost 25% felt that stimulus was not doing what it was designed to do.

- Office demand is likely to dip, over 1/3 of respondents felt that extended periods of working from home will have a negative impact on office demand.

- May doesn’t look much better, more than half felt rent collections may be about the same as April or worse.