The capital markets play a significant role in the investment and continued growth of the commercial real estate sector. The outlook of the financial landscape and what we can expect from the capital markets in 2016 has a significant impact on investment decisions this year.

In 2015, we saw a stable, strong financial landscape with ample capital sources available to meet the demand and the continued growth of the market. However, the question remains – What can we anticipate from the  capital markets in 2016?

capital markets in 2016?

Factors at Play

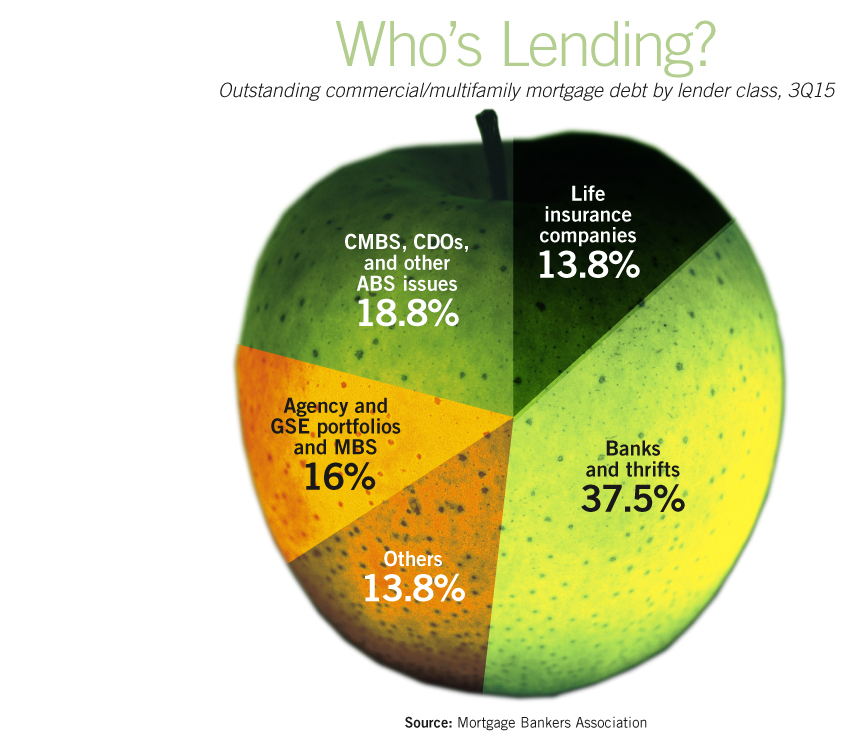

Capital Availability. The number of capital sources available will remain strong throughout 2016. With that said, we will continue to see the gap widen between the costs of capital available in major metropolitan areas and in small metros.

Most of the large national lenders have been investing and will continue to remain active in U.S. major metropolitan markets, with the small exception of those heavily influenced by oil. Regional and local lenders will remain the option for the smaller metro areas.

This division of investor size creates a disparity in costs. Smaller markets have a higher cost of capital than larger markets due to the lack of competition from large, national lenders who choose not to operate in those smaller areas.

Interest Rates. As we closed out 2015, the Federal Reserve began its first steps in increasing short-term interest rates and predicted future increases throughout the new year. Because real estate pricing is more heavily tied to long-term rates, we anticipate that this initial move by the Fed to increase short-term interest rates may not have a significant impact on commercial and investment real estate lending.

CLICK HERE FOR FULL ARTICLE AT CCIM.COM